Tariff Fraud Calculator

Understanding how we calculate the estimated value of tariff fraud and fraudulent trade

Calculation Methodology

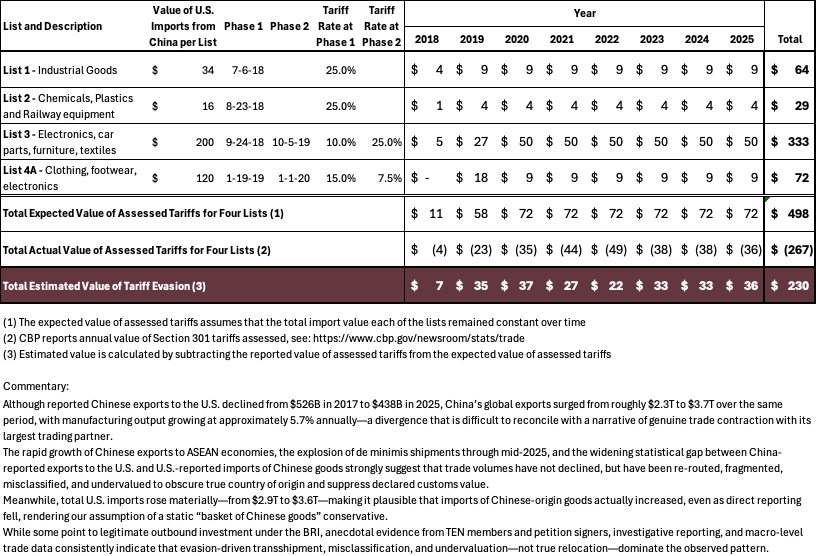

The Scope of Customs Fraud: A $230 Billion Gap (2018–2025)

If the value and composition of U.S. imports from China had remained constant after 2018, U.S. Customs and Border Protection (CBP) should have collected approximately $498 billion in Section 301 tariffs between 2018 and 2025, based on announced tariff rates applied to roughly $370–$380 billion of covered Chinese imports per year.

Key Assumptions & Data Sources

Fixed Baseline

Section 301 tariff-eligible imports maintained at ~$370B to provide consistent measurement framework

Evasion Methods

Accounts for undervaluation, misclassification, and transshipment through third countries

Data Sources

CBP Section 301 Assessment Data, US Census Bureau U.S. Trade Deficit Data and U.S. Import Data, Goldman Sachs, CPA De Minimis Analysis

Time Period

Calculations cover January 2018 through December 2025, coinciding with Section 301 implementation

Important Limitations & Disclaimers

Estimation Methodology: These figures represent estimates based on available trade data and observed patterns. Actual fraud amounts may vary due to the covert nature of these activities.

Data Limitations: Trade fraud is deliberately concealed, making precise measurement challenging. Our methodology provides a reasonable approximation based on observable trade flow anomalies.

Evolving Tactics: Fraud methods continuously evolve, and our calculations may not capture all emerging schemes or their full impact.

Policy Context: These estimates are intended to inform policy discussions and should be considered alongside other economic and enforcement data.